Thinking of buying art? Buy this book first!

How To Collect Art by Magnus Resch redefines how to buy art in the 21st century - for beginner and battle-scarred collector alike

In the opaque world of buying contemporary art Magnus Resch is both guide and disrupter, challenging widely held beliefs with data-driven insights.

The How To Collect Art author is on a mission to democratise access to a world that’s so often unfathomable to most of us, by creating simple-to-understand category layers and segments to give us confidence when buying art.

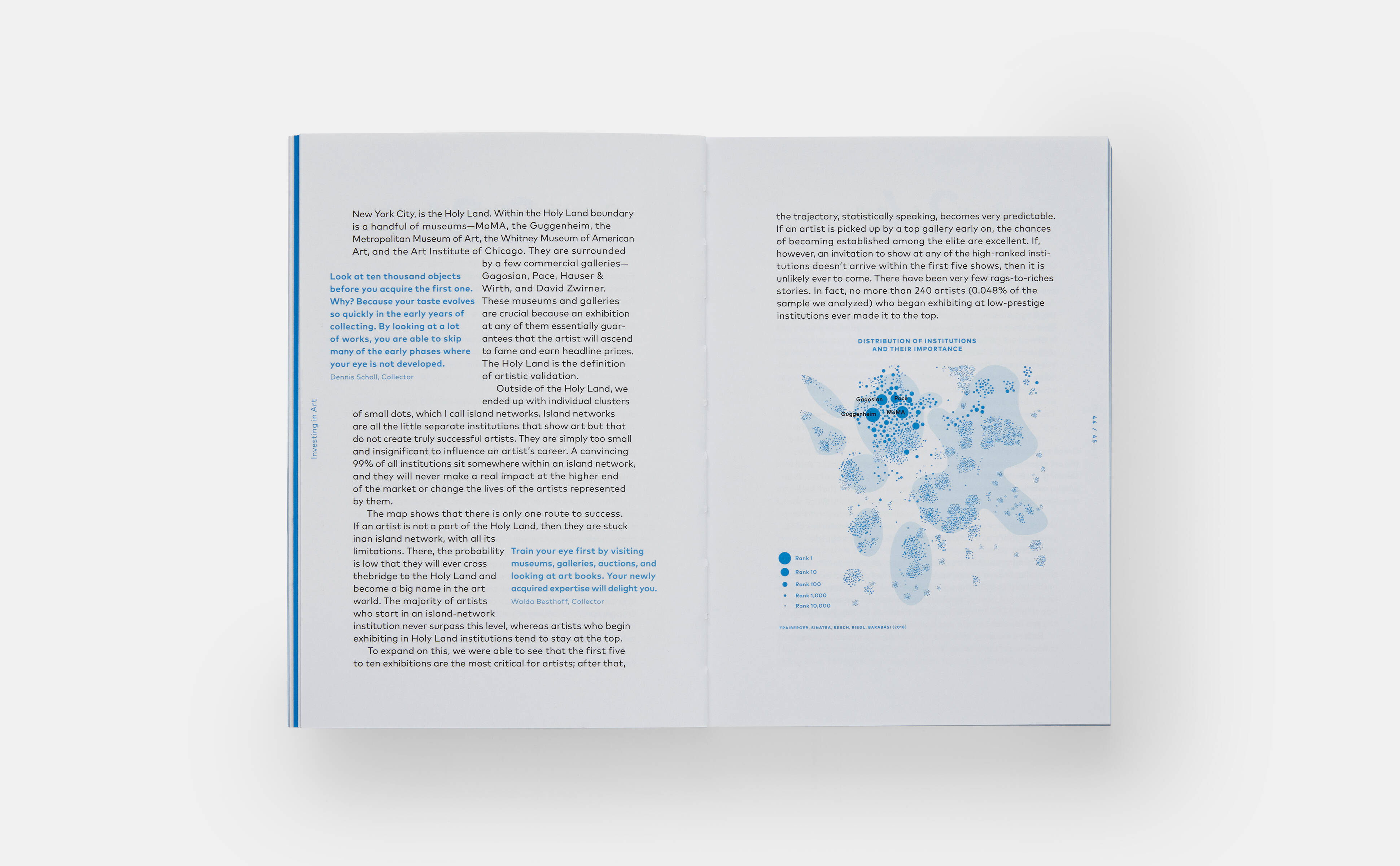

His stratifying of the gallery hierarchy into Alpha, Beta, Gamma, and Delta galleries makes it plain to understand what you should pay, what you should expect and what you’ll actually get when buying a work of art.

But behind all of the data, all of the myth busting, all of the reader useful advice that’s garnered him a huge number of social media followers is his market-research backed belief that the best reason to buy art is not because you believe it might make you rich one day, but because you truly love it.

With his slightly unorthodox approach, entrepreneurial spirit, and incredible intellectual fire power, Resch has carved a niche for himself as slightly maverick, yet entirely trustworthy, shaking up the art world status quo with his companies Gymondo.de (exit), Magnusclass.com, Larryslist.com and Magnus.net, the Shazam for art.

His latest book, How To Collect Art really does deliver on the promise of its title, giving potential and seasoned collectors alike salient advice on which auction houses and galleries to buy from; while providing entertaining tips and real world stories, and quotes and case studies from esteemed art world professionals, including mega collectors such as Shelley and Philip Aarons, Beth Rudin DeWoody, and Howard E. Rachofsky; museum directors Adam Weinberg and Heidi Zuckerman; art fair founder Touria El Glaoui; mega art dealers Marc Glimcher, Jeffrey Deitch, and Simon de Pury; art curator Hans Ulrich Obrist; superstar art advisor Amy Cappellazzo; and artist Julian Schnabel.

Along the way he introduces readers to concepts such as ‘responsible buying’—making a purchase knowing that it supports an artist, that artist’s community, and the continuation of that artist’s creative practice—and why ‘holy land’ galleries are so important when considering art as both a joy and an investment (pretty much all art, he argues, is not).

His own journey into the art world began at the age of 20 when he co-ran an art gallery in Switzerland in order to finance his university career.

He holds a Ph.D. in economics and studied at Harvard, the London School of Economics and the University of St. Gallen. He has been profiled in the New York Times, WSJ, Vanity Fair and the Financial Times. He is a regular speaker at conferences about the future of the art market, NFTs, Blockchain and investing in art. His career was the subject of a Harvard Business School case study, which has been taught in the MBA class every year since 2018.

With his pioneering spirit, and unyielding determination, Resch continues to challenge conventions, spark dialogue, and redefine the possibilities of what art can be. He was kind enough to take time out of a busy pre-Frieze LA schedule to share a little of his knowledge with Phaidon.com and bust some myths along the way. As he intimates in our interview, his love for art is the key driver in all this - the metrics almost - almost - play second fiddle. When you've read the article buy How To Collect Art.

What made you want to write this particular book? My goal is to provide guidance to newcomers venturing into the art market, serving as their trusted advisor as they embark on their collecting journey. I aim to assist them in purchasing their first and thirteenth piece without the need for a large budget or concerns about overpaying. Why? Because the art market requires new buyers.

Despite a doubling in the global number of millionaires and record attendance at art events over the past decade, the number of buyers has remained stable. This highlights a conversion issue, where the newly affluent struggle to seamlessly transition into art buyers. I firmly believe that a blend of education, entertainment, and transparency can tackle this challenge by enticing more art enthusiasts to become active buyers.

How does it differ from other books on the topic? While many books in the art market rely on anecdotal stories and personal experiences, my approach takes a different path by leveraging data. Rather than imposing my viewpoint, my aim is to present readers with an unbiased and comprehensive summary based on rigorous and verifiable data analysis. This book draws upon a six-year data study, recognized as 'the paper of the year' and published in Science, the world’s leading academic journal.

Acknowledging the limitations of data, I complement it with insights from interviews conducted with over 200 art market experts. These include prominent figures such as mega collectors like Shelley and Philip Aarons, Beth Rudin DeWoody, Jorge M. Pérez, and Howard E. Rachofsky; museum directors such as Adam Weinberg and Heidi Zuckerman; art fair founders such as Touria El Glaoui; art dealers such as Marc Glimcher, Adam Lindemann, Jeffrey Deitch, and Simon de Pury; art curators such as Hans Ulrich Obrist; art advisors such as Amy Cappellazzo; or artists such as Julian Schnabel.

Give us a couple of key takeaways from your book? Firstly, my book aids in identifying artists that are worth investing in by explaining strategies to pinpoint them. Secondly, it provides invaluable insights into the workings of the enigmatic art market, guiding readers on selecting reputable galleries, following influential curators, and attending relevant art fairs, thus ensuring they make informed purchases and avoid overpaying. Ultimately, the goal is to equip readers with the knowledge and confidence to become savvy and discerning buyers in the art world.

What’s the piece you bought that changed your life? I posed the same question to over 200 art collectors, and overwhelmingly, their first artwork purchase holds special significance—just as it does for me. At the age of 16, I acquired an edition by Munich artist Rupprecht Geiger, marking the beginning of my journey in the art world. Living with that artwork and encountering it daily likely unknowingly fuelled my desire to become more deeply involved in the art industry. It still hangs in a special place today.

What does 'responsible buying' mean to you? Responsible buying goes beyond mere financial transactions; it's a philanthropic gesture. Instead of viewing art solely as an investment, I see purchasing art as a form of donation. While I may not anticipate reselling the piece, I recognize that my support enables the artist to keep creating, thus nurturing the artistic community and fostering human creativity. For me, it's a way of giving back, accompanied by an object I cherish and a story worth sharing.

Do you have a set ratio between art you buy because you love it and art you buy because, while you love it, it's also a smart buy? In my book, I delved into the pricing strategies of 500,000 artists to unveil the factors that distinguish a great investment. Our research highlighted the crucial role of an artist's gallery network in determining their success. Investing in artists represented by reputable galleries substantially enhances the potential for a positive return.

However, entry into this category often starts at over $100,000. Given that I typically purchase art below this threshold, my approach centres on acquiring pieces that genuinely resonate with me, fully aware that I may not see any financial return on them. However, I find fulfilment in knowing that my support benefits the artist, the gallery, and the broader artistic community. That's why I place great importance on getting to know them—building connections and fostering relationships that extend beyond mere transactions.

The myth around buying low and selling high was one of the many interesting parts of the book and one that is believed in by so many people. Is it really as brutal as you say? Yes, but it’s even more tough for those working in the field: many artists struggle to sustain their practice financially, while numerous galleries operate at a loss. Pursuing a career in art often leads to uncertain prospects, with an art degree statistically linked to the highest unemployment rates amongst any degrees. Yet, I hold immense respect for those who pour their passion into their craft despite these challenges. Unfortunately, the general audience may overlook the struggles artists face. Moreover, collectors can be misled by headlines touting record-breaking prices, falsely promising lucrative returns on art investments.

In my book, I aim to dispel this misconception by empowering readers to discern top-tier artists from the vast pool. By providing tools for informed decision-making, I hope to steer collectors away from overpaying for artworks. Additionally, I emphasize the intrinsic value of art beyond its monetary worth. For me, art collecting transcends financial gain; it's about supporting artists I admire and finding genuine joy in ownership. This ethos forms the foundation of my book.

What’s the smart way to buy print editions, and is an edition by a 'holy land' artist more likely to be a good investment than an original work for the same price by a non-'holy land' artist? Indeed, editions by established artists represented by top galleries serve as a good starting point for new collectors. Platforms like Artspace.com excel in curating such artists and offering their works at accessible prices.

As for my own evolution as a collector, my initial attraction to editions by renowned artists gradually gave way to a deeper appreciation for art that resonated with me personally, regardless of the artist's fame. Indeed, this shift towards appreciating the aesthetic qualities of art and supporting artists is indicative of a larger trend among collectors. Collectors such as Komal Shah, who actively supports female artists, and Victoria Rogers, the founder of the Black Trustee Alliance for Art Museums aimed at amplifying Black voices in the U.S. art community, exemplify this purpose-driven approach to collecting.

Are NFTs over, will they bounce back, or will some other digital entity replace them? I've always harboured a deep admiration for digital artists, even though their market remains relatively small compared to traditional painting, which dominates over 90% of the art world's value. The recent buzz surrounding NFTs has shone a spotlight on blockchain technology, which I believe is not just a passing trend but a revolutionary force with lasting implications for the art market. That's why I discuss it in my book, too.

I'm convinced that the convergence of digital art, cryptocurrency, and blockchain technology has the potential to fundamentally reshape the art ecosystem. This transformation will grant painters greater autonomy over their creations, allowing them to earn royalties from subsequent sales and reduce transaction costs. However, realizing these changes will take time and necessitate the initial adoption of blockchain technology by other luxury industries. Given the art market's tendency to follow rather than lead, this evolution may unfold gradually.

What are you looking forward to in 2024? I maintain an optimistic outlook for 2024. Despite initial concerns, the art market has demonstrated remarkable resilience, particularly for high-quality works. I anticipate ongoing refinement in the ultra-contemporary category, as well as a strengthening of established positions throughout the year. Additionally, I am hopeful that my book, alongside other initiatives within the art market, will play a role in converting more visitors into buyers. This is essential for the continued vitality of the art market, enabling galleries, artists, advisors, museums, and auction houses to pursue their passions with confidence and enthusiasm.

Buy How To Collect Art.